A tale of two canola tariffs: China’s tariffs are on a small portion of Canada’s canola production

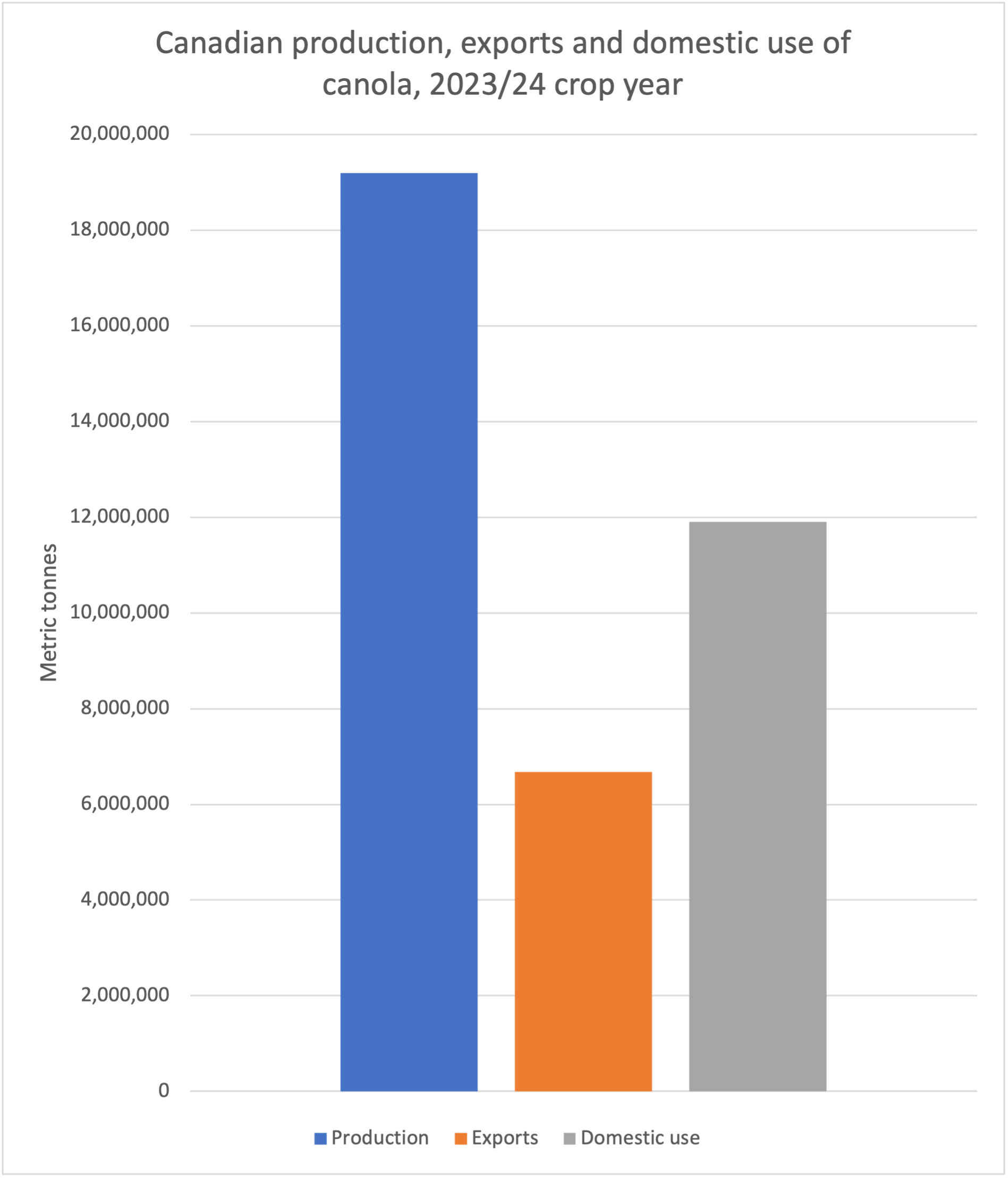

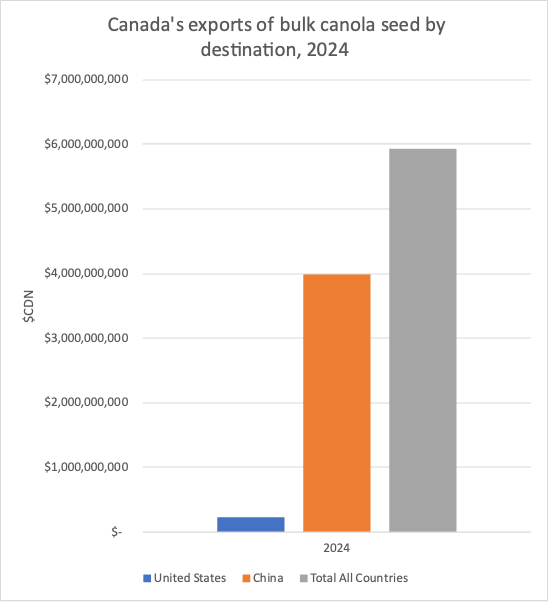

Headlines about China’s tariff on canola are raising alarm and concern among farmers. Many popular and influential media stories imply this tariff applies to all canola, when in fact it affects only China’s imports of canola oil and meal, not their canola seed imports. These stories highlight the tariff rate (100%), but not the fact that it would affect only the portion of total canola produced which is crushed for export to China. When farmers sell canola at the elevator, they are paid for the bulk commodity: it is the processor that sells the crush products— oil and meal— and the end-user would pay the tariff or else buy an alternative product.

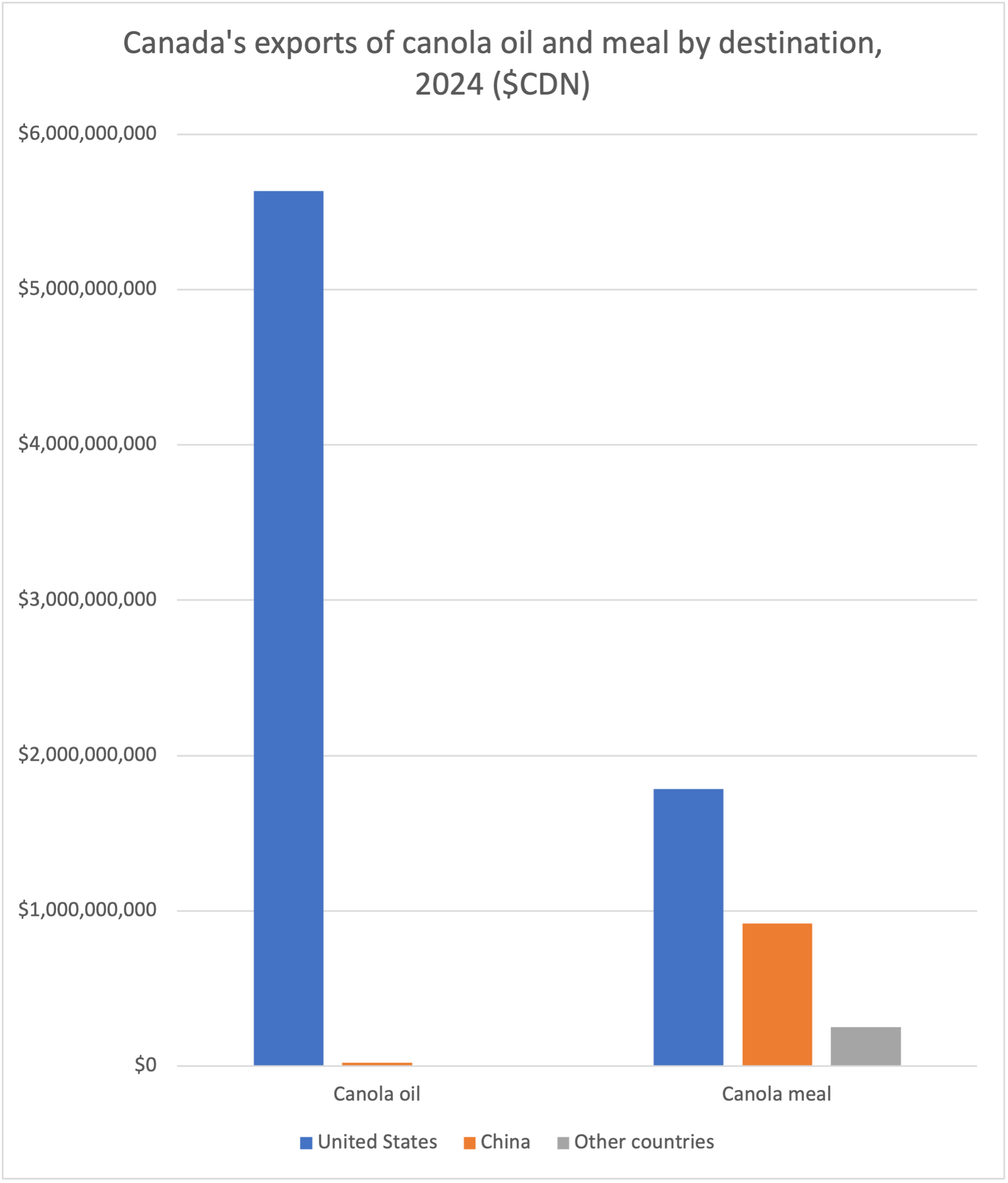

In contrast, the USA is threatening a 25% tariff on all imports— including canola oil, meal and seed. This would affect over $5.6 billion worth of canola oil sourced from Canada in 2024, exponentially higher than China’s $20 million-worth. Similarly, in 2024, US imports of Canadian canola meal were $1.8 billion, about twice the value of China’s $CDN 918 million.

In fall 2024, China announced it would impose its retaliatory tariff effective March 20, 2025 on Canadian canola meal and canola oil in response to finding that Canada’s imposition of tariffs on its electric vehicles (EVs) at 100%, and on aluminum and steel at 25%, is discriminatory. These Canadian tariffs match the USA’s 100% tariff on Chinese EVs, while the European Union imposed a 37.5% tariff on Chinese EVs at that time. The rationale in all three cases is to limit competition from lower cost Chinese EVs in order to promote development of North American and European EV manufacturing sectors.

The USA, unprovoked by Canada, and supposedly a partner in the CUSMA trade agreements, is threatening to put a 25% tariff on all of the Canadian canola it imports— seed, oil and meal— effective April 2, 2025. The total value of canola seed, oil and meal exported to the USA in 2024 was $ 7.7 billion, including just $237 million worth of bulk commodity canola. The tariff on that amount of sales would add $1.925 billion to US tax revenues (paid by the importer)— more than double the value of China’s retaliatory tariffs.

China is willing to negotiate removal or reduction of its tariff. However, while this tariff on oil and meal is in effect, China will likely find other sources for these products, such as Australia, or possibly import more Canadian bulk canola to crush. In 2024 the total value of Canada’s canola oil and meal exports to China was $938 million.

The likely impact of the American tariff is harder to assess, since President Trump appears to be using tariffs as a weapon to weaken other countries’ economies or as punishment for perceived offences. If threatened tariffs are imposed across all products traded by most countries, the ability of American buyers to adjust by finding substitute products or alternative sources will be limited. The ability of American farmers to produce enough crop to fill any gaps will be affected by the higher prices they will have to pay for imported inputs, and yields may be affected by the increasing severity of climate change impacts. The USA’s market for vegetable oils of any kind— soy, corn, palm, canola— for use in biofuels is very uncertain, as the viability of the sector depends on government policy— both fuel mandates and subsidies. Biofuel production is likely to drop on both sides of the border, affecting demand.

For Canadian farmers, the price impact of the tariffs will depend on how the highly concentrated grain sector behaves. Six multinational corporations, Cargill, Louis Dreyfus, Richardson, ADM, Bunge and Viterra, own Canada’s canola crushing facilities, and four of them— Cargill, Richardson, Bunge and Viterra also buy canola from farmers at the country elevator. The relationship between the price end-users pay and the price farmers are paid is not transparent. When farmers have few choices for where to sell, the buyers are able to use their market power to depress prices unfairly. The biggest impact on farmers of the Chinese tariff situation may not be lost sales to China, but increased profiteering by the vertically integrated grain and oilseed processing multinationals. Alarmist news stories over China’s retaliatory tariffs can easily be used to excuse low prices.